Hot Take: Facebook Is Doomed

It's time to face facts: Facebook is in serious trouble, and its days of dominance as a marketing platform are probably numbered.

It's time to face facts: Facebook is in serious trouble, and its days of dominance as a marketing platform are probably numbered.

For over a decade, Facebook has reigned supreme as the go-to social media site for businesses looking to reach customers. With over 2.9 billion monthly active users, it's been hard to ignore. Thanks to its tempting promise of unparalleled audience size and targeted advertising capabilities, the social media network has convinced many marketers that it offers the greatest potential for engagement and ROI. As marketers, we’ve invested heavily in building communities and running ads on Facebook.

But its popularity and effectiveness for marketers have been deteriorating rapidly in recent years. Usage has declined sharply among younger demographics, with teens opting for newer, "cooler" apps like TikTok. Overall engagement rates on Facebook pages have dropped to low levels, organic reach has plummeted, and businesses frequently complain about poor returns from investing in Facebook ads.

Facebook’s Future Fades

The events of the past few years - from the Cambridge Analytica scandal to countless data leaks - have also severely damaged public trust in the platform. Facebook just isn't as "hip" or influential as it once was, and for many users its reputation has gone from trendy tech startup to creepy data hoarder. Marketers can’t ignore the signs that Facebook is providing diminishing returns.

When I examine the mounting statistics, they paint a bleak picture for Facebook's future as a marketing channel. In this “hot take,” I’ll discuss why the time has come for brands to start re-evaluating their Facebook marketing strategies and consider alternatives. While you may not want to jump ship yet, Facebook's glory days in the marketing world are over as audience attention shifts elsewhere.

Faces Are Booking It

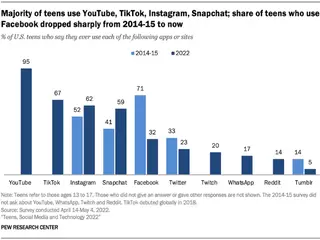

Facebook's decline in popularity among key demographics poses a major problem for its future success. Teen usage of Facebook has dropped significantly, as younger users shift attention to newer platforms. A 2022 Pew Research study found only 32% of teens use Facebook, compared to 71% seven years prior. Instead, platforms like TikTok and Snapchat now dominate the 13-17 age demographic. Younger generations are clearly finding Facebook less appealing and spending time on competing apps. They associate Facebook with older relatives more than a "cool" social space.

Beyond demographics, Facebook's reputation has also been badly damaged from endless security issues and data privacy scandals. Users have lost trust, with 54% believing Facebook has a negative impact on society according to a 2021 AP-NORC poll. This distrust is motivating some to close accounts or cut back on usage. Brand safety concerns have further accelerated this exodus, as controversial content and misinformation drive users away.

With its popularity declining across multiple measures, Facebook's grip over consumers continues to slip. Marketers can no longer assume the expansive reach that made Facebook a stable investment in years past. Engaging the next generation of buyers will require looking beyond Facebook sooner rather than later.

Calling Off the Engagement

It's not just Facebook's usership that is declining - engagement rates on Facebook have dropped precipitously as well. This suggests that even those users who remain active on Facebook are less attentive and responsive than they once were.

Facebook's algorithm changes have exacerbated this problem enormously. Organic posts on Facebook used to average 16% reach in 2014 but averaged as low as 5.2% in 2021. Paid advertising now accounts for the vast majority of views, as organic visibility has nearly vanished. Businesses are forced to rely on ads just to reach their existing followers.

But even Facebook ads appear to be losing potency. Many marketers complain of skyrocketing costs and lower conversion rates on FB advertising. As users scroll past promoted posts, click-through rates have dropped. And without detailed targeting data due to Apple's privacy changes, ads can't be personalized as they once were.

Between vanishing organic reach and reduction in ad performance, Facebook’s engagement is not what it used to be. Maintaining an audience requires unsustainably high ad spends, pointing to the platform's disappearing relevance among once fervent users.

Gen Z’s Aversion to Conversion

Facebook's decline is further underscored by their inability to effectively monetize younger demographics, both on Facebook itself and their other properties like Instagram. This does not bode well for long-term revenue growth.

Younger users have been difficult for Facebook to commercialize given their lower attention span for ads and wariness of branded content. Ad recall is poor among Gen Z markets, and young consumers have proven challenging for Facebook to convert via retargeting efforts. Their interests are also more fragmented across many niche apps.

Younger users have been difficult for Facebook to commercialize given their lower attention span for ads and wariness of branded content. Ad recall is poor among Gen Z markets, and young consumers have proven challenging for Facebook to convert via retargeting efforts. Their interests are also more fragmented across many niche apps.

Controversies like the 2021 "Instagram Kids" project have highlighted Facebook's scramble to get a foothold with pre-teen users. But attempts to aggressively expand their underage audience have sparked backlash over child safety and screen time concerns. Regulations may curb Facebook's options for participating in this market.

And investors have grown skittish about Facebook's dependence on aging audiences. Over half of its user base is now 35+, leaving the platform vulnerable as younger generations shift to new networks. Focusing innovation on attracting youth has become more urgent.

But these efforts will likely continue facing headwinds as younger consumers remain wary of Facebook's data handling and uninterested in its fading brand cachet. Facebook's formula for monetization depends on high engagement from demographics it increasingly struggles to capture.

Video Killed the Status-Quo Star

The rise of mobile and video usage presents another existential threat to Facebook's relevance for marketers. While visual, video-centric apps like TikTok and Snapchat now dominate youth attention, Facebook remains stubbornly text and image focused.

Mobile video consumption has exploded, expected to comprise over 85% of online traffic by 2022. But Facebook was late to embrace video and has failed to meaningfully differentiate its offerings. YouTube, TikTok and Snapchat all outpace Facebook for short-form video innovation and usership.

And despite talk of a "pivot to video," Facebook itself is still predominantly geared to desktop usage. Complex cross-platform video uploads and poor mobile video viewer experience indicate Facebook has yet to crack the mobile experience.

This opens opportunities for other social platforms to siphon away marketing dollars as video advertising matures. With richer formats like Stories and vertical video, newer apps provide better canvases for impactful video ads. As audiences fragment across apps, Facebook's one-stop "walled garden" looks increasingly outdated.

The trends toward mobile and video dominance show no signs of stopping. As consumers spend more time watching and engaging with video on their phones, Facebook risks losing both users and marketing dollars to competitors riding the video-first paradigm shift.

A Marked Shift for Marketers

The evidence paints a concerning outlook for Facebook as a marketing tool. Declining usage among young demographics, diminishing organic engagement, loss of user trust and failure to capitalize on emerging video and mobile behaviors all signal that Facebook's time in the sun is ending.

Marketers can no longer cling to outdated assumptions about Facebook's dominance in reaching audiences. Its reputation has been tarnished, competition has grown fiercer, and innovations in areas like video and privacy have left Facebook flat-footed.

Brands must face reality and start re-evaluating their Facebook marketing investments and strategies. I wouldn’t jump ship yet as Facebook still provides some value, such as the ability to A/B test creative ad output with a wide audience in a short time frame. However, while it’s not dead yet, the platform is losing steam. Over-reliance on Facebook is now a risky approach likely to waste budgets on declining returns.

Savvy marketers need to get ahead of the curve and diversify efforts across multiple newer platforms favored by younger users. They should pilot new video ad formats and capitalize on innovations like live-streaming and short-form video. And resources should shift away from Facebook toward channels where competition for attention is less saturated.

The era of Facebook marketing dominance is definitively over. The smart move now is not to cling to the past but to embrace the next generation of social advertising. Change comes quickly in digital marketing - and Facebook is looking more and more like old tech.

Michael Cheng,

Account Manager